When Tesla Model 3 owners queue at charging stations, when smartphone users carry power banks daily, and when drones cannot achieve long-distance flights due to battery limitations, humanity's demand for breakthrough innovations in energy storage technology grows increasingly urgent. In this race for energy revolution, solid-state batteries emerge as a dark horse, rewriting the rules of the power battery industry. This technology, hailed as the "Holy Grail of Batteries," is breaking through the physical limits of traditional lithium-ion batteries and sparking a disruptive energy storage revolution.

I. Disruptive Breakthroughs in Solid-State Batteries

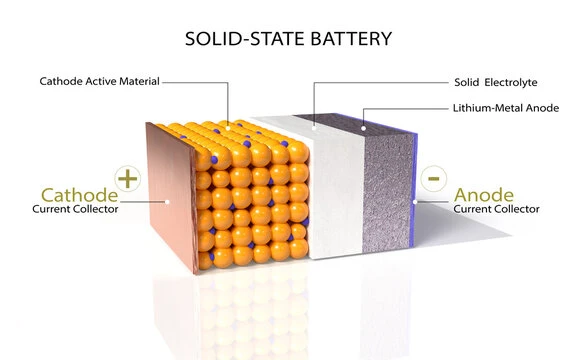

In the sandwich structure of traditional lithium-ion batteries, liquid electrolytes act like flowing blood, conducting lithium ions between the cathode and anode. While mature, this structure harbors fatal flaws: flammable and volatile electrolytes, and an energy density ceiling. The innovative revolution of solid-state batteries begins with reconstructing the electrolyte—replacing liquid electrolytes with a solid electrolyte film. This 20-micron-thick ceramic or polymer material essentially "solidifies" traditional electrolytes into an intelligent filter membrane.

In laboratory settings, solid-state batteries demonstrate staggering performance metrics: energy density exceeding 500Wh/kg (double that of top-tier ternary lithium batteries), 15-minute fast charging to 80% capacity, and zero combustion in nail penetration tests. This quantum leap stems from the unique physical properties of solid electrolytes, where lithium ions travel shorter, more direct paths through solid media—akin to speeding on a highway.

Breakthroughs in materials science continue fueling this revolution. Sulfide solid electrolytes achieve ionic conductivity of 10^-2 S/cm, rivaling liquid electrolytes; lithium metal anodes boost theoretical capacity tenfold; 3D solid electrolyte structures reduce interface impedance by 80%. Behind these numbers lie relentless research efforts in nanomaterials synthesis and interface engineering.

II. Technological Battles on the Industrialization Path

The road to mass production is thorny. Brittle oxide electrolytes result in less than 30% yield, while sulfide electrolytes demand production environments with humidity below 0.1%. A German lab's atomic layer deposition technology constructs nano-level transition layers on electrolyte surfaces, slashing interface impedance from 300Ω·cm² to 50Ω·cm²—a breakthrough enabling 1,000-cycle lifespans.

Manufacturing processes face revolutionary challenges. Conventional roll-to-roll production fails with brittle electrolyte films. Toyota's pulsed laser deposition technology builds battery structures layer-by-layer with nanoscale precision in vacuum environments, despite quintupling equipment costs. CATL's solid electrolyte spray coating reduces production costs by 40%.

Cost curves are shifting dramatically. At 400/kWhin2023,solid−statebatterycostsareprojectedtodropto400/kWhin2023,solid−statebatterycostsareprojectedtodropto150/kWh by 2026 through sulfide electrolyte scaling. BMW and Solid Power's pilot production line shows 60% cost reductions at 10GWh capacity—far outpacing lithium-ion battery cost declines over the past decade.

III. Reshaping Global Industries: The Rising Star

Global automakers have entered a solid-state battery arms race. Toyota, holding 1,300 patents, plans full solid-state battery production by 2027; Volkswagen injected an additional $300 million into QuantumScape; China's NIO announced 150kWh semi-solid-state battery packs (1,000km range) for 2024. This competition is restructuring automotive value chains, potentially reducing battery costs from 40% to 25% of total vehicle costs.

Application scenarios are multiplying exponentially. In consumer electronics, 0.3mm solid-state batteries liberate foldable device designs; paired with solar systems, they boost home energy storage efficiency by 30%; Airbus's solid-state battery drones achieve 24-hour continuous flight. These expansions are creating new markets exceeding $200 billion.

Technology roadmaps are crystallizing: First-gen oxide solid-state batteries will debut by 2025, sulfide systems mature by 2030, and ultimate lithium-air solid-state batteries may emerge by 2040. This stepwise innovation ensures 30%+ performance gains per generation, driving continuous technological waves.

IV. Global Wisdom Tackling Technical Bottlenecks

At the University of Tokyo, scientists use cryo-electron microscopy to observe lithium dendrites penetrating solid electrolytes. They discovered that sub-5-micron electrolytes trigger "quantum tunneling effects," offering new strategies to suppress dendrite growth. Samsung's gradient pressure stacking technology uses seven electrolyte layers with varying moduli to increase interface contact pressure from 10MPa to 200MPa, solving interface delamination during cycling.

Regional R&D strategies diverge: Japan bets on sulfides—Sumitomo Chemical's Li9.54Si1.74P1.44S11.7Cl0.3 electrolyte achieves 25.8mS/cm conductivity; China focuses on oxides—Tsingtao Energy's LLZO electrolyte achieves nano-level grain boundary control; QuantumScape's flexible ceramic electrolyte overcomes brittleness, maintaining integrity at 1.2mm bending radii. These divergent paths are shaping a multipolar global supply chain.

V. The Butterfly Effect on a Trillion-Dollar Industry

Solid-state batteries are redrawing raw material maps. Global lithium demand is projected to surge from 87,000 tons (2023) to 620,000 tons (2030), while cobalt/nickel usage drops 40%. This shift ignites resource wars: China, Japan, and Korea vie for Bolivia's lithium triangle; Congolese cobalt giants pivot to lithium refining. Deeper impacts hit equipment sectors—ALD device markets grow 15x in three years; Canon Tokki's vacuum evaporators hit $30 million per unit.

Industrial ecosystems undergo structural shifts: Traditional separator firms like Enjie invest 30% of R&D budgets in solid electrolyte coatings; electrolyte leader CAPCHEM transitions to Li3PS4 precursor production (99.9999% purity). This disruption creates new industrial nodes: Interface modification materials will surpass $5 billion by 2025; solid-state battery testing equipment demand grows 120% annually.

VI. Energy Power Shifts Under Policy Drivers

The EU's "Battery 2030+" roadmap commits €3.2 billion to solid-state R&D, mandating 30% recycled solid electrolytes by 2030. The U.S. Inflation Reduction Act offers 45/kWhtaxcredits(3045/kWhtaxcredits(3020 billion in government-guided funds.

Standardization battles intensify: IEC's draft safety standards reveal stark differences—Japan pushes extreme temperature cycling (-50°C to 150°C), China mandates nail penetration tests, while Germany advocates 10GPa interface pressure tests. These clashes foreshadow two decades of global battery industry dominance struggles.

VII. Reimagining Future Energy Landscapes

When solid-state batteries hit 800Wh/kg, urban energy networks will transform radically: Building-integrated photovoltaics and solid-state storage walls will form distributed microgrids; home storage systems could reach 500kWh (one month's usage). Transportation will see revolutionary changes—electric planes achieving 3,000km ranges, eliminating transcontinental jet fuel needs.

In medical technology, 0.1mm solid-state batteries enable next-gen implants. Medtronic's neural stimulators extend lifespans from 5 to 20 years; Boston Dynamics' Atlas humanoid robots operate for 72 hours (vs. 90 minutes), enabling real-world applications.

This energy revolution is redefining civilization's foundations. At $0.01/Wh storage costs, renewables could meet 90% of global energy needs; with 10,000-cycle lifespans, "energy immortality" transitions from sci-fi to reality. Solid-state batteries aren't merely a technological advance—they're the key to sustainable development. In this future, energy will become as ubiquitous as air, and the countdown to transformation has already begun.

For more information, please contact us:ciclibattery.com