3 Positives from Tesla's Q2 2025 Shareholder Update?

We’ve closely covered Tesla’s sales decline, and we’ve discussed the potential for an ongoing sales decline at length. Naturally, a continued decline in sales could significantly hurt Tesla’s finances. Also, it’s hard — or impossible — to justify the company’s market cap if the company isn’t going to return to fast, or hyperfast, growth. Perhaps we’ll write more about Tesla’s sales and financial trends now that the company’s Q2 2025 shareholder letter is out, but given that we’ve written about that so much, it was actually three potential positive notes from the shareholder letter that caught my eye. Are they a sign of life, hope, and potential for Tesla? Or are they more of a shiny object and distraction? Well, let’s get to what these three positives are and I’ll let you decide — I don’t know. 1. First Builds of Affordable Tesla Model in June A new, more affordable Tesla model was supposed to go into production in June, a missed milestone that we covered a couple of times recently. However, the company did note in the shareholder letter that first builds of the model were created in June. Additionally, Tesla is planning on volume production of the model in the second half of 2025. So, even though things are a bit behind schedule, it doesn’t look like a big miss and it seems we can expect this new model to come out in coming months. Of course, we don’t know any real details around this more affordable model, and there are still questions about how much it will boost sales versus take sales from the Model 3 and Model Y, but this product expansion is a key thing critics and fans have been calling for, so it’s a good sign that this is still more or less on track. 2. Volume Production of Semi The Tesla Semi was the Tesla product I was most excited about … for years … and years. Unfortunately, mass production has taken far longer to arrive than I and others hoped and expected. It’s so far behind schedule that I think most of us forget about it and write it off. However, Tesla noted prominently in its quarterly letter that development of the Semi (and Cybercab) has been continuing and volume production is planned for next year (for both the Semi and the Cybercab). 3. Energy Storage Business Doing Quite Well While vehicle sales have drooped, many Tesla investors have been keen to point out that the company’s energy storage business has been growing strongly. And it has. Tesla notes that “Trailing twelve-month Energy storage deployments achieved their12th consecutive quarterly record.” One of the company’s few financial pros in the 2nd quarter was “growth in Energy Generation and Storage gross profit.” That said … growth in this segment did clearly slow down. If you look at the chart below and pay attention to how the bars were growing quarter after quarter, Q2 2025 stands out for almost leveling off rather than seeing similar growth to other quarters. But back to the positives, the good thing is that Tesla recognizes this as a massive need and is trying to make the most out of its battery skills. In the shareholder update, Tesla wrote “The Energy business is more critical than ever. The availability of clean, reliable energy is necessary for economic growth and an imperative for the development and commercialization of AI enabled products and services. As electricity demand grows, our Megapack product helps to increase utilization of existing generation and transmission capacity, resulting in a more efficient use of the electric grid. When paired with solar PV, Megapack is cost competitive with traditional fossil fuel generation assets and can be deployed 4x faster than traditional fossil fuel plants of the same capacity. Trailing twelve-month Energy storage deployments achieved their 12th consecutive quarterly record.” Indeed. Any other matters — positive or negative — that you think stand out from this quarter’s shareholder update from Tesla? Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News! Advertisement Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here. Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent. CleanTechnica uses affiliate links. See our policy here. CleanTechnica's Comment Policy

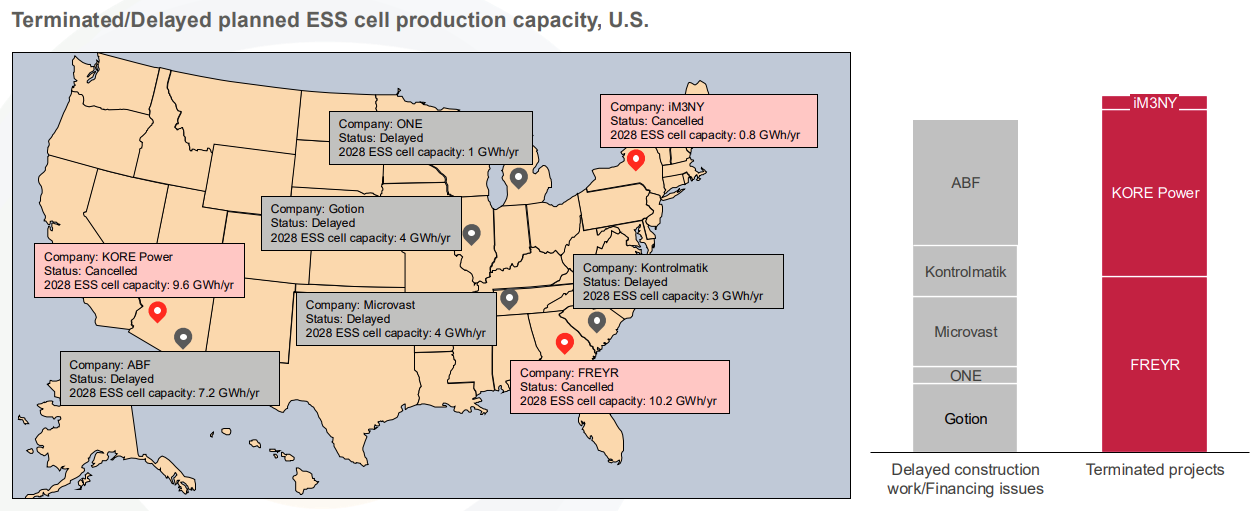

‘21GWh of US ESS cell manufacturing capacity cancelled this year’: Clean Energy Associates reports

‘21GWh of US ESS cell manufacturing capacity cancelled this year’: Clean Energy Associates reports - Energy-Storage.News Skip to content

Tesla (TSLA) Q2 2025 earnings call updates

Tesla’s (NASDAQ:TSLA) earnings call comes on the heels of the company’s Q2 2025 update letter, which was released after the closing bell on July 23, 2025. Tesla’s Q1 2025 Results: Total Revenues: $22.5 billion Total automotive revenues: $16.7 billion Total GAAP gross margin: 17.2% Gross Profit: $3.88 billion Advertisement Learn how car insurance is calculated, what factors affect your rates and what you can do to help lower costs. EPS non-GAAP: $0.40 per share The following are live updates from Tesla’s Q2 2025 earnings call. I will be updating this article in real time, so please keep refreshing the page to view the latest updates on this story. 16:22 CT – Good day to everyone, and welcome to another Tesla earnings call live blog. Tesla had a pretty big quarter, and while the company’s vehicle deliveries are still down year-over-year, the Robotaxi pilot has been launched in Austin. Now to see if this earnings call starts on time. Interestingly enough, the EV maker has not posted a link to its Q2 2025 earnings call livestream on its official @Tesla X account yet. 16:26 CT – The earnings call’s livestream on YouTube, however, is up: 16:28 CT – I wonder which Elon we will get on today’s earnings call? Will be get super locked-in Elon, serious Elon, or lighthearted Elon? Whichever Elon we get, TSLA stock will probably show some reaction in after-hours trading. 16:30 CT – Travis Axelrod of Tesla’s Investor Relations team opens the call. He states that Tesla CEO Elon Musk and other executives are present. And, here’s Elon’s opening remarks. 16:33 CT – Elon opens with the launch of Tesla’s Robotaxi service in Austin, which has gotten “bigger and longer” over the past few weeks. He stated that the service area for Robotaxi services in Austin will get even bigger and longer soon. He mentions the Robotaxi service’s expansion to the Bay Area, Arizona, and Florida in the coming months. “I think we’ll have Robotaxi in half the population of the US by the end of the year?” Musk said, highlighting that this is subject to regulatory approval. He added that Tesla is expanding its Robotaxi service cautiously. 16:35 CT – Elon noted that the Model Y became the best-selling car in several countries in n Türkiye, Netherlands, Switzerland and Austria in June. This was despite the Model Y selling in these countries without its killer feature–FSD. Despite the regulatory challenges, Elon noted that Tesla will get these approvals, and he is hoping that some areas in Europe should experience FSD in the coming months. “It really is the single biggest demand driver,” Musk said. 16:37 CT – Elon also mentioned the launch of the Tesla Diner. “This is a very special diner,” Musk said, stating that the facility is a “shining beacon of hope.” He joked that it is rare that a diner makes the news, but the newly launched restaurant is quite something. On the other hand, Elon noted that Tesla is making significant improvements to its FSD software, and that the company could probably 10X the parameter count from what users are currently experiencing. 16:43 CT – The CEO also highlghted the growth of Tesla Energy, which he noted was a “really big deal.” As for Optimus, Musk stated that the humanoid robot is in its current second generation. Its third generation will be “exquisite,” the CEO noted. “Tesla is by far the best in the world in real-world AI,” Musk said. He threw some shade at Waymo as well, stating that while Google is good at AI, the tech giant is not as good in real-world AI applications. All those years producing and designing cars matter. “Tesla has the highest intelligence density in AI so far,” Musk said. “Intelligence density will be a very big deal in the future.” 16:46 CT – Musk stated that Tesla will probably see prototypes of Optimus Version 3 this year, and scale production next year. Tesla will be ramping these initiatives as fast as possible, considering the company’s aspirations to produce millions of Optimus robots per year. Musk believes that a rate of 1 million Optimus robots per year is feasible within five years. “We’re not always on time, but we get it done,” Musk said, referencing the company’s tendency to make the impossible feel late. He also reiterated the idea that Tesla can be the omst valuable company in the world if it executes very well. 16:50 CT – Tesla CFO Vaibhav Taneja mentioned the company’s milestone of delivering a car autonomously to a customer for the first time in Q2. He also mentioned the effects of the Trump administration’s regulatory changes for electric vehicles. He mentioned that Tesla is seeing more test drives, and the company did start the production of more affordable cars in the first half of the year, with volume production planned for the second half of the year. 16:55 CT – Investor questions begin with an inquiry about Tesla Robotaxis. Tesla noted that it expects to 10X its current operation in the coming months. The Bay Area is next, and Tesla is looking to expeedite the service’s approval. As for technical and regulatory hurdles for Unsupervised FSD, Elon Musk stated that he believes the feature should be available in a number of cities by the end of the year. Tesla, however, is being extremely paranoid about safety, so Unsupervised FSD’s rollout will be very, very cautious. Also, Tesla vehicles from Fremont could deliver themselves to customers autonomously by the end of the year. 16:58 CT – A question about Optimus was asked. Elon noted that Optimus V3 is the right design for the humanoid robot, since it has all the degrees of freedom necessary to ensure that it can do tasks very well. He also set expectations on Optimus’ ramp. “If we are not making 100,000 OPtimus robots per month in 60 months, I will be shocked,” Musk said. Another question was asked about Tesla’s affordable model. Tesla noted that production did start in the first half of 2025, and a ramp is expected in the

EcoFlow OCEAN Pro: A Smarter, Scalable Solar Battery For Whole-Home Backup

The new EcoFlow OCEAN Pro Solar Battery System is designed to do more than just keep the lights on. It’s a powerful, all-in-one energy solution that combines solar energy storage, backup power, and intelligent energy management to support an entire home, even during extended outages or peak energy demand. Whether you’re looking for energy independence, disaster preparedness, or lower electric bills, the OCEAN Pro is built to deliver. Key Benefits Whole-Home Power, Even During Outages: With 24 kW of continuous output and the ability to surge up to 50 kW, OCEAN Pro can run just about everything in your home, including air conditioners, EV chargers, and kitchen appliances — at the same time. It can even handle large startup loads with its 205 A locked-rotor amp (LRA) capacity. Expandable Battery Storage: The base unit starts with 10 kWh of battery capacity and can be scaled up to 80 kWh by stacking additional battery modules. That means you can customize the system to fit your home’s energy needs, whether you’re living in a small house or a large, high-consumption home. Massive Solar Input Capacity: With support for up to 40 kW of solar input through multiple MPPT channels, OCEAN Pro is ideal for homes with large rooftop solar systems. It charges quickly and reduces your reliance on the grid. Flexible Power Sources: It integrates seamlessly with rooftop solar, grid power, and even portable gas generators. If your battery runs down completely, it can still reboot using a connected gas generator — no manual intervention required. Smart Energy Management: What sets the OCEAN Pro apart is its AI-powered energy optimization. It learns your energy habits, forecasts solar production, and adjusts battery usage to lower your utility bills. In time-of-use (TOU) mode, it can shift consumption to cheaper hours and maximize solar savings, reportedly cutting costs by up to 118%. App & On-Device Control: The system features a built-in LED display that gives you quick access to real-time energy usage, battery levels, and power flow. For deeper insights, the EcoFlow app puts you in full control of your energy system, from battery management to EV charging and backup status. Grid Services & Income Potential: OCEAN Pro can participate in virtual power plant (VPP) programs. That means you can potentially sell excess energy back to the grid and earn income, not just save money. Built For Harsh Conditions: The unit operates in temperatures ranging from –4 °F to 140 °F, with built-in insulation, fire protection, and flood resistance. It’s designed for safety and long-term reliability. Long-Term Peace Of Mind: EcoFlow backs the OCEAN Pro with an industry-leading 15-year warranty, making it a serious investment in your energy future. Who It’s For This system is ideal for: Homeowners who want whole-home backup, not just critical loads Solar users who want to maximize self-consumption and reduce grid dependence People living in areas with frequent outages, high electricity costs, or extreme weather Anyone interested in joining a virtual power plant or earning from their energy system Why Choose EcoFlow OCEAN Pro? Specs: Continuous Output: 24 kW Surge Output: Up to 50 kW Battery Capacity: 10–80 kWh Solar Input: Up to 40 kW Backup Support: Grid, solar, gas generator Smart Control: LED panel + EcoFlow App Optimization: AI learning, TOU scheduling Durability: Weatherproof, insulated, fire/flood-safe Warranty: 15 years Learn more about the OCEAN Pro Solar Battery System at EcoFlow, or get personalized advice via a free one-on-one energy consultation to find out how much can you save with an OCEAN Pro system. Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News! Advertisement Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here. Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent. CleanTechnica uses affiliate links. See our policy here. CleanTechnica's Comment Policy

Developer goes to Massachusetts regulator for BESS approval

Developer goes to Massachusetts regulator for BESS approval - Energy-Storage.News Skip to content

Elon Musk reveals big plans for Tesla Optimus at the Supercharger Diner

Elon Musk revealed on X on Wednesday that Tesla Optimus will soon be getting a job at the Supercharger Diner in Los Angeles, and its role will be right on par with what we believed the humanoid bot would be perfect for. While Optimus was spotted serving popcorn at the Diner on Monday as it opened for the first time, that’s its only job, at least for now. Musk said Optimus will be getting a promotion in 2026, and it will be a food runner, bringing your order straight to your car, eliminating the need to go inside yourself. It will complete what Tesla hopes is a full-fledged 50s diner experience, curated by the imagination of the future. In the 1950s, drive-in diners were a common hangout to grab a bite and watch a movie. Tesla opened its Supercharger Diner in Los Angeles earlier this week, but it has a futuristic twist to it. You can order food directly from your car, sync your center touchscreen and speakers to the two massive projection screens that Tesla is playing movie scenes on at the Diner, and even go inside for a true break from your car. Next year, Tesla will take it a step further, Musk confirmed: Optimus will bring the food to your car next year pic.twitter.com/opPGjOe7t1 — Elon Musk (@elonmusk) July 23, 2025 The Diner features 80 Superchargers that can be used by both Tesla and non-Tesla EVs, provided that the manufacturer of the electric car has access to the company’s robust network. It is also available to non-EV owners, as they can park their cars and stop in for a quick bite to eat. Tesla’s full menu at the Diner is available here, and its focus for the restaurant was to provide healthier options by sourcing most of its food from local, organic, and humane farms: We put a lot of effort into using truly organic ingredients from farms that we have visited — Elon Musk (@elonmusk) July 22, 2025 Optimus’s capabilities seem to be progressing to a point where Tesla feels confident that the humanoid robot can handle carrying food and delivering it to customers at their cars. Whether it will be put on roller skates is another question, but we’re hopeful Optimus can do it when it gets its promotion next year.

Transport Decarbonisation Is A Lever For Industrial Competitiveness But The EU Budget Fails To Capitalise On It

Last Updated on: 17th July 2025, 03:10 am T&E reaction to the post-2027 EU budget proposal The budget proposal released today fails to leverage transport decarbonisation to boost industrial competitiveness, T&E said, as resources allocated to scale up clean technologies are inadequate. The budget’s new key program, the European Competitiveness Fund (ECF), only allocates €67 billion for the climate transition and industrial decarbonisation over a seven year period, €40 billion of which comes from an already existing instrument. However, public funding needs for transport cleantech manufacturing alone require €39 billion annually by 2030. Support for critical technologies such as batteries and e-fuels for aviation and shipping is essential to boosting the bloc’s competitiveness, energy security and strategic autonomy. But the scarcity of funding in the ECF, together with the broad scope of technologies that qualify for funds, risks sidelining key transport investments. In the battery industry alone, up to 100,000 new jobs that could be created by 2030 are at risk with this proposal, T&E said. The proposal does send some positive signals in support of an EU green industrial strategy. The ECF will be able to deploy production aid to ramp-up the manufacturing of clean products, while this wasn’t allowed in previous budgets. “Made in EU” requirements are also introduced, giving companies using local technologies and suppliers privileged access to EU funds. Xavier Sol, Sustainable Finance Director at T&E, said: “This budget’s proposals include promising elements on production aid and local content, but the Competitiveness Fund, as proposed, is not yet the powerful green industrial engine it aims to be. Europe needs to develop and strengthen cleantech value chains and deploy green technologies at scale. Without sufficient financial firepower, it risks becoming an irrelevant player. It’s too little, but not too late to change course.” A 35% target for climate and biodiversity investments enables investments in renewables, energy efficiency and climate resilience, but it is not sufficient to stay on track with EU climate objectives. Fossil fuel subsidies are not ruled out either. And the dismantling of the LIFE program, the EU’s core instrument for climate and environmental action, is also concerning, T&E said. The doubling of the Connecting Europe Facility (CEF) is welcome, but by leaving the implementation of key national rail projects in Member States’ hands, the Commission risks jeopardizing an effective deployment of the EU’s core rail network. To finance the budget, T&E advises that lightly taxed and heavily polluting sectors, such as aviation and shipping, should be included in the plan. An EU-wide kerosene tax could generate approximately €21.25 billion annually if applied to all departing flights from the EU. Similarly, marine fuel taxes could raise about €24 billion annually. Xavier Sol adds: “Europe needs a major investment boost to become more competitive, sustainable and prosperous. This requires a focused, impactful and predictable investment plan. This proposal is only a first timid step in that direction.” Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News! Advertisement Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here. Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent. CleanTechnica uses affiliate links. See our policy here. CleanTechnica's Comment Policy

Tesla adds Lucid to this extensive list of EV makers

Tesla (NASDAQ: TSLA) is set to report its earnings for the second quarter of 2025 tomorrow, and although Wall Street firm Wedbush is bullish as the company appears to have its “wartime CEO” back, it is looking for answers to a few concerns investors could have moving forward. The firm’s lead analyst on Tesla, Dan Ives, has kept a bullish sentiment regarding the stock, even as Musk’s focus seemed to be more on politics and less on the company. However, Musk has recently returned to his past attitude, which is being completely devoted and dedicated to his companies. He even said he would be sleeping in his office and working seven days a week: Nevertheless, Ives has continued to push suggestions forward about what Tesla should do, what its potential valuation could be in the coming years with autonomy, and how it will deal with the loss of the EV tax credit. Tesla preps to expand Robotaxi geofence once again, answering Waymo These questions are at the forefront of what Ives suggests Tesla should confront on tomorrow’s call, he wrote in a note to investors that was released on Tuesday morning: “Clearly, losing the EV tax credits with the recent Beltway Bill will be a headwind to Tesla and competitors in the EV landscape looking ahead, and this cash cow will become less of the story (and FCF) in 2026. We would expect some directional guidance on this topic during the conference call. Importantly, we anticipate deliveries globally to rebound in 2H led by some improvement on the key China front with the Model Y refresh a catalyst.” Ives and Wedbush believe the autonomy could be worth $1 trillion for Tesla, especially as it continues to expand throughout Austin and eventually to other territories. In the near term, Ives expects Tesla to continue its path of returning to growth: “While the company has seen significant weakness in China in previous quarters given the rising competitive landscape across EVs, Tesla saw a rebound in June with sales increasing for the first time in eight months reflecting higher demand for its updated Model Y as deliveries in the region are starting to slowly turn a corner with China representing the heart and lungs of the TSLA growth story. Despite seeing more low-cost models enter the market from Chinese OEMs like BYD, Nio, Xpeng, and others, the company’s recent updates to the Model Y spurred increased demand while the accelerated production ramp-up in Shanghai for this refresh cycle reflected TSLA’s ability to meet rising demand in the marquee region. If Musk continues to lead and remain in the driver’s seat at this pace, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.” Tesla will report earnings tomorrow at market close. Wedbush maintained its ‘Outperform’ rating and held its $500 price target.

Germany funds two lithium projects by Vulcan Energy

The German Federal Ministry for Economic Affairs and Energy (BMWE), as well as the federal states Rhineland-Palatinate and Hesse, are funding two lithium projects by Vulcan Energy with a total of €103.6 million. The projects involve lithium chloride extraction in Landau and further processing in Frankfurt-Höchst. The BMWE sees funding for both projects as another step towards securing an affordable and reliable supply of raw materials for German industry – with lithium being particularly crucial for electric vehicle production. The metal is required for manufacturing EV batteries. Vulcan Energy states that its project, titled “Clean Lithium for Battery Cell Production” (Li4BAT), will in the future supply lithium for around 500,000 EV batteries annually. Currently, there is no significant lithium production in Germany or Europe, with the raw material largely sourced from China and South America. Vulcan Energy estimates total investment for both plants at €690 million, with €103.6 million now covered by the federal government, Hesse, and Rhineland-Palatinate. Vulcan Energy CEO Cris Moreno comments: “We are pleased about the strong and concrete support from the federal government as well as the state governments of Rhineland-Palatinate and Hesse. This funding will enable us to provide sustainable domestic lithium for the German and European electric mobility sector. The raw material drives the energy transition and is key to switching to electric mobility.” Vulcan Energy already demonstrated with pilot plants at both sites that lithium extraction and processing in Germany is possible. In April 2024, the company reported its first successful production of lithium chloride at its Lithium Extraction Optimisation Plant (LEOP) in Landau, which is about 1:50 scale compared to the planned commercial Lithium Extraction Plant (LEP) that now received funding. Here, lithium chloride is extracted from geothermal brine. And at the Lithium Electrolysis Optimisation Plant (CLEOP) in Frankfurt-Höchst, also built at 1:50 scale, Vulcan Energy processed lithium chloride into lithium hydroxide monohydrate for the first time in November 2024. Stefan Rouenhoff, Parliamentary State Secretary at the Federal Ministry for Economic Affairs and Energy, said: “By supporting Vulcan Energy’s investment projects in Hesse and Rhineland-Palatinate, we are helping to establish sustainable lithium production in Germany. This reduces our dependency on raw materials and strengthens the resilience of our supply chains. That is a key prerequisite for the competitiveness of our economy.” The sub-project in Landau, Rhineland-Palatinate, was already selected by the EU in March 2025 as one of 47 strategic projects under the Critical Raw Materials Act. Vulcan Energy’s combined geothermal and lithium resource is considered the largest in Europe, with licences concentrated in Germany’s Upper Rhine Valley. Rhineland-Palatinate’s Minister for Economic Affairs, Daniela Schmitt, said: “I am pleased that Rhineland-Palatinate can make an important contribution to strengthening Germany as an industrial location with this lithium project. It is an investment in the future viability of the German economy. Domestic lithium production will allow us to supply our industries more reliably with raw materials.” Hesse’s Minister for Economic Affairs, Kaweh Mansoori, added: “Climate-neutral lithium extraction from regional resources is a key building block for the mobility and energy transition. For Hesse, this project is a strategic investment in the future: it strengthens our high-tech location, secures jobs, and creates prospects for future generations.” bundeswirtschaftsministerium.de, v-er.eu (both in German)

GM Takes Aim At Tesla's Energy Storage Business, Too

Tesla’s spiraling brand reputation crisis has hit its EV sales so hard that the much-hyped Tesla Cybertruck was reportedly outsold by General Motors’s GMC electric Hummer in Q2. Now GM has spotted an opportunity to horn in on Tesla’s Megapack utility scale energy storage business, too — with an assist from none other than Tesla co-founder and former CTO JB Straubel. General Motors Spots An Energy Storage Opportunity There’s a lot of history to unpack here, so let’s start with the fresh news first. On July 16, GM and Redwood Materials announced their intention to collaborate on utility-scale energy storage systems in the US, aiming squarely not at EVs but at the burgeoning needs of the AI data center boom. That’s an interesting turn of events for GM. Here in the US, the EV market is somewhat uncertain these days. The Republican majority in Congress decided to make the $7,500 EV tax credit expire on September 30, raising the specter of a doomslide into negative sales territory for all EV makers, not just Tesla. However, if GM can successfully market batteries for stationary energy storage, it may be able to offset some of the EV losses until the electric mobility market — and the political situation — both improve. After all, why let good energy storage technology go to waste? GM has been pitching its Ultium EV battery platform since 2019. In the latest development, earlier this week, GM’s Ultium Cells venture with LG Energy Solution announced its intention to commercialize new low-cost EV lithium-iron-phosphate batteries by late 2027. The new agreement with Redwood Materials comes just about a month after Redwood announced its new Redwood Energy branch, aimed at using new batteries and second-life EV batteries for “fast, low-cost energy-storage systems built to meet surging power demand from AI data centers and other applications,” Redwood and GM stated in a press release that takes a shot across the bow of Tesla’s AI data center Megapack business. The new agreement calls for the use of GM’s second-life (aka used) EV batteries as well as newly GM manufactured batteries, too. In a press statement, GM and Redwood both emphasized that the new batteries would be Made in the USA batteries, going right up against Tesla’s domestically manufactured Megapack brand (Megapacks are made in California, with a secondary facility in Nevada). Kurt Kelty, VP of batteries, propulsion, and sustainability at GM, also chipped in his two cents. “The market for grid-scale batteries and backup power isn’t just expanding, it’s becoming essential infrastructure,” he said in a press statement announcing the new agreement. “Electricity demand is accelerating at an unprecedented pace, driven by AI and the rapid electrification of everything from transportation to industry,” added Redwood CEO JB Straubel. He founded Redwood in 2017, shortly before leaving his CTO position at Tesla, to seek new opportunities in the lithium-ion battery recycling field. New Life For Second Life EV Batteries The new collaboration builds on a second-life EV battery collaboration between GM and Redwood, in which GM batteries have been deployed at a Redwood facility in Nevada to provide energy storage for the AI infrastructure firm Crusoe. At 12MW/63MWh, the storage system is billed as the largest second-life battery system in the world, and the biggest microgrid system in North America, too. Repurposing used EV batteries may seem like a step downward from the glamorous universe of Tesla into the nuts-and-bolts world of waste management, but money talks. By 2023, Redwood assembled $4 billion in funding including a $2 billion conditional loan guarantee from the US Department of Energy. Besides, extracting lithium from spent batteries is just part of Redwood’s business plan. Using the lithium to make new battery elements is another part. “We’re building a huge (Airbus A380 for scale) cathode plant with more than 1 million EVs/year of capacity at our Nevada Campus,” Straubel announced last year. “We’re reducing both the construction cost and the build time through ambitious and detailed engineering, focusing on innovative practices in the plant’s very design and development.” “Cathode accounts for >50% of a battery cell’s cost but today, manufacturing is based entirely outside of North America,” he added (see more Redwood background here). More Energy Storage Competition For Tesla Like Tesla, GM and Redwood are moving past an initial focus on EV batteries to exploit new opportunities in the stationary energy storage business. In Tesla’s case, the Megapack has been a lifesaver. As widely reported here and elsewhere, Tesla’s EV sales are sliding downwards in Europe, the US, and other key markets, but Megapack sales are booming. On GM’s part, the new energy storage venture could provide the company with some financial wiggle room until the current occupant of the White House turns the reins of federal government over to more responsible hands — peacefully this time, one hopes. GM has not exactly been sitting around waiting for the wheels of the next presidential election cycle to begin turning. On July 14, GM president Mark Reuss posted a recap the activities of his company’s Ultium Cells venture under the headline, “From Tennessee to Michigan, GM is building a battery-powered future.” “With the Ultium Cells sites in Spring Hill and Warren, Ohio, GM has the largest OEM battery cell manufacturing capacity in this country,” Reuss stated, affirming GM’s intention to manufacture several different kinds of battery chemistries including NCMA (nickel cobalt manganese aluminum) pouch cells as well as the forthcoming LFP batteries and an LMR (lithium manganese rich) formula. “GM plans to be the first company to produce LMR prismatic battery cells at commercial scale. This advancement is key to delivering the best mix of range, performance, and affordability for our EV customers,” Reuss added. “Our expertise in these three battery chemistries will enable us to scale production of lower-cost LMR and LFP cell technologies so we can produce both full-size electric pickups and affordable EVs like the Chevrolet Bolt,” Reuss added again for good measure, in case anyone needs an extra reminder that GM intends

'Flow battery cost reductions and limitations of lithium': Invinity CCO on LDES tech drivers and opportunities

Though he mentions that the system has apparently outperformed expectations since going into operation a year ago, the topic of our conversation begins far outside Europe. It focuses on Invinity’s newest partnership with Chinese battery materials and manufacturing specialist Guangxi United Energy Storage New Materials Technology Limited (UESNT). As covered in our news story about the licensing and royalty agreement last week, the London Stock Exchange-listed vanadium redox flow battery (VRFB) provider believes it can leverage the relationship to achieve lower costs in production and supply chain. That means licensing UESNT to manufacture Invinity’s latest generation flow battery product, Endurium, for the Chinese market. When ESN Premium last heard from Matt Harper, as the Anglo-American VRFB company launched Endurium, in December 2024, the CCO said Invinity saw China’s dominance in the flow battery space as an opportunity, rather than a threat. As Harper explained then, the Chinese flow battery industry is not based around modular, productised VRFB solutions like Invinity’s Endurium, meaning there could be an addressable market gap the company could play into. Furthermore, Chinese vanadium electrolyte producers Invinity was speaking with could potentially offer “phenomenal pricing” on the batteries’ key ingredient, the Invinity CCO said at the time. “When we looked at the Chinese market a year ago, we saw the price point at which these flow battery projects were being built in place. That’s not going to be directly within reach with Endurium yet, but with the UESNT partnership, we think we can get the cost of the modular products down to a point where it does directly compete.” On the flip side, and arguably even more importantly, Invinity sees UESNT as a partner that can lower the costs of its product for the global market. BloombergNEF figures from a few months ago cited the cost of flow batteries in China as being lower than half the global average. “China is like the ‘New York’ of the flow battery industry. If you can make it there, you can make it anywhere!” Harper says. This matters because, although Invinity has made enough progress in commercialisation that it is the only non-lithium player so far to make it onto both Bloomberg’s Tier-1 energy storage providers’ list and Solar Media Market Research’s BatteryTech Bankability ratings report, as a technology class flow batteries—and indeed non-lithium electrochemical technologies in general—still lag far behind lithium-ion in adoption across the stationary storage space. Will China be the driver of the global ‘VRFB story’? Regular and perhaps exceptionally devoted readers of our quarterly journal, PV Tech Power, might recall that in the Q3 2021 edition (Vol . 28), we examined the energy storage market strategies of two primary vanadium producers, Bushveld Minerals and Largo Resources. As part of that deep dive, we heard from Erik Sardain, a principal consultant with the natural resources market analysis firm Roskill at the time, that the future success of vanadium redox flow batteries (VRFBs) would likely depend on China’s attitude toward the technology. “I believe that the VRFB story is going to be driven by China, because it’s not only based on economics, it’s also based on politics. Because if the Chinese government says, ‘Let’s go for it,’ then they will go for it,” Sardain said. Indeed, the Chinese government did go for it. In addition to existing in its natural form in the ground, the metal is a by-product of steelmaking. Through this, the country is already the biggest source of vanadium in the world, and the government has also turned its hand to supporting the deployment of large-scale flow batteries. While that programme saw some stops and starts, the first long-duration projects at a scale of hundreds of megawatts and many more megawatt-hours have since come online. For Invinity, UESNT symbolised the progress China has made in technology and materials since its energy storage policy focus diversified to include flow batteries, as well as lithium-ion (Li-ion) and other tech. “Electrolyte, or the vanadium that stands behind it, is really what got the UESNT team excited about this deal in the first place. Their pedigree is in minerals processing [in the BESS space],” Harper says as he makes his way over to the Gamesa Electric project site. “Without getting into too sensitive detail, UESNT are implementing some processing techniques and supply chain optimisations that, in our view, really change the game in terms of how the medium can be converted from materials in the ground, or recycled materials, to the electrolyte that we need.” Invinity perceived UESNT to be the best-in-class in the world at doing this, although Harper says that he expects others to follow its lead. This would be a long-term win-win, creating “a fundamentally downward pressure on the prices of the materials and the systems” across the industry. From upstream cost reduction to downstream demand growth However, he says, anyone concerned that Invinity’s partnership with a low-cost Chinese manufacturer could spell the end of production from its existing assembly plants in Canada and Scotland, UK, need not worry. “We still intend to manufacture our core technology ourselves. That’s a critical piece of what we do. Not only from an IP management perspective, but really, the manufacturing of our stacks and the optimisation of how the system works at a controls and electronics level, we know how to do that better than anyone else,” he says. “When it comes to manufacturing our stacks, it’s not about stack design. It’s about the processes, the quality control. It’s about the techniques in the manufacturing process that get us to the kind of performance and costs that our products need.” Invinity will utilise the UESNT team, its manufacturing relationships and source of supply, but intends for those to feed the factories that the company already has in operation. Rendering of Endurium VRFB units at a project site. Image: Invinity. For flow batteries to proliferate as a commercial prospect, it isn’t just supply-side progress that needs to be made. Downstream demand also needs to be there. With liquid

Sphere Energy Wins New Product Competition at Advanced Automotive Battery Conference Europe – Battery Power Online

Sphere Energy Wins New Product Competition at Advanced Automotive Battery Conference Europe By Battery Power Staff June 26, 2025 | Sphere Energy was awarded the Best of Show People’s Choice Award at this week’s Advanced Automotive Battery Conference Europe, in Mainz, Germany. The award honored Sphere Energy’s new product ASC-IP, an isostatic pressure cell for advanced pouch cell testing. The Best of Show People’s Choice Awards is open to all Advanced Automotive Battery Conference Europe exhibitors with new products that are available for purchase at the event. The more than 1,000 AABC Europe attendees surveyed exceptional innovation in technologies in the battery space and voted on the most impactful new products of the year. Sphere Energy was announced as the winner on Wednesday, June 25. Sphere Energy wins the 2025 Best of Show Award at AABC Europe. Here are the full details on Sphere Energy’s new product: Sphere Energy | ASC-IP | Booth 803https://www.sphere-energy.eu/ ASC-IP: Isostatic Pressure Cell for Advanced Pouch Cell Testing The ASC-IP is a novel electrochemical test cell designed to evaluate pouch cells under fully isostatic pressure conditions — a significant evolution from conventional uniaxial setups. Built to meet the increasing demand for precision in solid-state battery (SSB) research, the ASC-IP allows researchers to apply uniform hydrostatic pressure (up to 6 MPa) across the entire cell surface, eliminating mechanical anisotropy and enabling more reliable data on stress-sensitive behaviors such as interfacial stability and ionic transport. What makes the ASC-IP unique is its built-in pressure monitoring system with direct analog output to a potentiostat or cycler. This feature enables real-time synchronization of mechanical and electrochemical data, offering unprecedented insights into how pressure influences performance and degradation. The compact cell accommodates various pouch cell sizes (up to 108 × 75 × 10 mm) and tab geometries, with repositionable clamp- or screw-based electrical connectors and thermocouple access for temperature monitoring (0–80 °C). A manual hydraulic pump is included for precise pressure control, supported by both visual (manometer) and digital pressure feedback. In solid-state battery testing, where interfacial contact and stack pressure are critical variables, the ASC-IP introduces a new standard — transforming pressure from a passive constraint into an active research variable.

Tesla 'Model Q' gets bold prediction from Deutsche Bank that investors will love

Two noted Tesla (NASDAQ:TSLA) bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership. While Wedbush analyst Dan Ives called on Tesla’s board to take concrete steps to ensure Musk remains focused on the EV maker, longtime Tesla supporter Cathie Wood of Ark Invest reaffirmed her confidence in the CEO and the company’s leadership. Ives warns of distraction risk amid crucial growth phase In a recent note, Ives stated that Tesla is at a critical point in its history, as the company is transitioning from an EV maker towards an entity that is more focused on autonomous driving and robotics. He then noted that the Board of Directors should “act now” and establish formal boundaries around Musk’s political activities, which could be a headwind on TSLA stock. Ives laid out a three-point plan that he believes could ensure that the electric vehicle maker is led with proper leadership until the end of the decade. First off, the analyst noted that a new “incentive-driven pay package for Musk as CEO that increases his ownership of Tesla up to ~25% voting power” is necessary. He also stated that the Board should establish clear guidelines for how much time Musk must devote to Tesla operations in order to receive his compensation, and a dedicated oversight committee must be formed to monitor the CEO’s political activities. Tesla Board of Directions…take the following 3 steps in our view 1. New pay package getting Musk to 25% voting control. Clears a path for xAI merger.2. Guardrails established for amount of time Musk spends at Tesla as part of pay package3. Oversight on political endeavors 🎯— Dan Ives (@DivesTech) July 8, 2025 Ives, however, highlighted that Tesla should move forward with Musk at its helm. “We urge the Board to act now and move the Tesla story forward with Musk as CEO,” he wrote, reiterating its Outperform rating on Tesla stock and $500 per share price target. Tesla CEO Elon Musk has responded to Ives’ suggestions with a brief comment on X. “Shut up, Dan,” Musk wrote. Cathie Wood reiterates trust in Musk and Tesla board Meanwhile, Ark Investment Management founder Cathie Wood expressed little concern over Musk’s latest controversies. In an interview with Bloomberg Television, Wood said, “We do trust the board and the board’s instincts here and we stay out of politics.” She also noted that Ark has navigated Musk-related headlines since it first invested in Tesla. Wood also pointed to Musk’s recent move to oversee Tesla’s sales operations in the U.S. and Europe as evidence of his renewed focus in the electric vehicle maker. “When he puts his mind on something, he usually gets the job done,” she said. “So I think he’s much less distracted now than he was, let’s say, in the White House 24/7,” she said. TSLA stock is down roughly 25% year-to-date but has gained about 19% over the past 12 months, as noted in a StocksTwits report.

Ultium Cells converts Spring Hill factory for LFP production

Ultium Cells, the joint venture between General Motors and LG Energy Solution, will convert its battery cell factory in Spring Hill, Tennessee, to produce LFP cells. Production is estimated to start at the end of 2027. According to the battery manufacturer, the conversion of battery cell production in Spring Hill to the production of LFP cells will begin this year, with commercial production scheduled to start at the end of 2027. The plan is to scale production of low-cost lithium iron phosphate battery cells, an initiative which builds on a $2.3 billion investment announced all the way back in 2021. The reasoning behind the move is to offer lower-cost batteries to enable the manufacturer to offer entry-level electric vehicles at lower prices. According to a South Korean media article published in June, Samsung SDI will therefore also convert part of its joint venture with GM in Indiana, which was originally intended purely for the production of nickel-rich batteries, so that LFP production lines can also be accommodated. LGES and GM currently only produce pouch cells with NMC chemistry in both US factories. It had been known for some time that the joint venture was aiming to switch to prismatic cells, whose structure is also better suited to LFP chemistry. With the official announcement of the conversion of the Spring Hill plant, GM has put an end to the speculation that was fueled by such statements and insider reports. At the same time, LGES and GM are also focusing on the development of lithium-manganese-rich batteries (LMR) – a new format that should retain the cost advantages of LFP while offering superior performance. Ultium Cells currently operates two cell factories in the USA, one in Warren, Ohio, since 2022 and another in Spring Hill, Tennessee, since 2024. While the former continues to produce cells with NMCA (nickel-cobalt-manganese-aluminium) chemistry, Spring Hill is to switch from this to the cheaper lithium iron phosphate chemistry. The joint venture has given itself two years to complete the reorganisation. Shareholder General Motors comments: “GM’s flexible EV platform is designed to enable the rapid integration of different cell chemistries and form factors. With LFP battery technology, GM is targeting significant cost savings in battery packs compared to today’s high nickel battery packs, while increasing electric car choices for consumers.” As GM announced in its current press release, the Spring Hill plant currently employs around 1,300 people. The company does not mention how the workforce will continue to be employed during the conversion. Kurt Kelty, Vice President of Batteries, Propulsion and Sustainability at GM, refers much more to the upcoming benefits for customers. “At GM, we’re innovating battery technology to deliver the best mix of range, performance, and affordability to our EV customers,” said Kurt Kelty, VP of batteries, propulsion, and sustainability at GM. “This upgrade at Spring Hill will enable us to scale production of lower-cost LFP cell technologies in the U.S., complementing our high-nickel and future lithium manganese rich solutions and further diversifying our growing EV portfolio.” Spring Hill has only been in series production mode since April 2024 The conversion, which involved a major effort, is remarkable in that it has only been a year and three months since Spring Hill produced its first series-produced NMC cells. In other words, the systems are all new and have only just been harmonised. The ground-breaking ceremony dates from 2021, and the change in strategy is testament to the high pressure that GM and its battery subsidiary in the USA are under. Against this backdrop, the car manufacturer recently sold a third Ultium Cells plant to joint venture partner LGES just before its completion, specifically the one in Lansing, Michigan. The plans for a fourth plant, which was to be built in New Carlisle in the US state of Indiana, were put on hold by GM and LGES at the beginning of 2023. GM strategy is a reflection of the political situation The new strategy naturally also has a political dimension. As Reuters recently reported, GM CEO Mary Barra met with US President Donald Trump in March to discuss US investment plans. She is also said to have told the President that GM needed a concession on the Californian emissions requirements in order to expand production in the USA. California and ten other US states are known to have adopted stricter environmental regulations than the national rules. In June, Trump signed a law that cancels Califonia’s regulations for zero-emission vehicles by 2035. Meanwhile, GM is recording growing sales figures in the USA for both petrol and electric vehicles. The company emphasises that it will have become the second-largest seller of electric vehicles in the USA in the second half of 2024 (January to May: 62,000 EVs sold), thanks to the 13 electric car models now available from its brands. And: Chevrolet was the fastest-growing electric vehicle brand in the country in the first quarter and is now number 2 among all electric vehicle brands. Between January and May, Chevrolet sold over 37,000 electric cars in the USA, Ford only 34,000, with Tesla leading the way. Meanwhile, GM’s capital expenditure forecast for 2025 remains unchanged at $10bn to $11bn. Looking ahead, GM expects annual capital spending to be between $10 billion and $12 billion by 2027, “driven by increased investment in the US, prioritisation of key programmes and efficiency offsets.” news.gm.com

Solar & Storage Stability: How America Can Maintain Energy Security Through Severe Weather

When extreme weather threatens lives and livelihoods, solar and battery storage are there to deliver energy security for the American people. Extreme weather events, from scorching heat waves to destructive hurricanes to frigid winter storms, are constantly challenging our aging infrastructure. When power lines fall or gas plants freeze, distributed solar and energy storage can be life savers, and over the past several years, these technologies are increasingly stepping up to deliver reliability and safety when it matters most. Heat Waves When the sun is at its hottest and demand peaks, solar power is a crucially important generation source. This June, large swaths of the country were scorched by a severe heat wave that stressed our aging grid. Demand for air conditioning soared, gas plants needed to reduce capacity, and the heat threatened rolling blackouts across the region. Thankfully, solar paired with battery storage stepped up to provide cool relief for American families. In New England, solar panels and a network of batteries supplied several gigawatts of power in key moments, saving households an estimated $20 million. This is no isolated incident. As heat waves have become more frequent and severe in recent years, solar and storage have been working overtime to make sure the AC stays on and people stay safe. Texas has led new solar additions for the last several years, and those investments have shored up resources in response to a heat wave in 2023 and have strengthened the grid in preparation for this summer. During Europe’s record heat wave this June, solar generation set records in 13 countries and was the largest source of electricity for the EU in June. Hurricanes When hurricanes threaten coastal communities, solar and storage provide life-saving energy resilience, powering recovery efforts and connecting families after the storm. After Hurricane Helene ravaged North Carolina, solar + storage’s ability to function separate from traditional grid systems provided a lifeline to communities across the state. Powering flashlights, power tools, and cell phone chargers for communication, solar and storage were critical to relief efforts. Solar microgrids aren’t just a quick fix in the aftermath, either. They’re a resilient choice for communities in storm after storm. Babcock Ranch — a Florida community powered entirely by solar microgrids — has been directly in the path of powerful hurricanes like Ian and has never lost power. Winter Weather Winter storms present special challenges to traditional energy infrastructure. During the February 2021 Texas Freeze, natural gas infrastructure like wellheads, pipelines, and compressor stations froze, cutting off fuel to generators and flipped off more than 52,000 megawatts of power. At least 4.5 million homes and businesses lost power, and more than 200 people lost their lives. Overreliance on a few large power plants made the Texas grid vulnerable. In response, the state has invested more than any other in new utility-scale solar projects since 2021. When severe winter storms hit again in 2024, Texas was prepared with a mixture of energy strategies, and solar + storage were there to lighten the load. Time after time, solar and storage step up when it counts most. That’s why more states are doubling down on solar and storage investments to keep grids running safely, reliably, and affordably. Simply put, solar and storage provide distributed, resilient energy that suffers fewer unexpected outages than traditional power plants, protecting communities and delivering energy security for families when they need it most. Article from Solar Energy Industries Association (SEIA). Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News! Whether you have solar power or not, please complete our latest solar power survey. Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here. Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent. Advertisement CleanTechnica uses affiliate links. See our policy here. CleanTechnica's Comment Policy

Harvey County in Kansas enacts lengthy 2.5-year BESS moratorium

Harvey County in Kansas enacts lengthy 2.5-year BESS moratorium - Energy-Storage.News Skip to content

Battery Power Online | OEMs at Advanced Automotive Battery Conference Europe 2025

By Kyle Proffitt July 16, 2025 | At the 15th international Advanced Automotive Battery Conference Europe held in Mainz, Germany, June 23-26, 2025, we heard from several automotive OEMs in keynotes and additional presentations, discussing very high power batteries for hybrids, which newer chemistries they are focused on, and how these chemistries can be integrated into standard form factor battery packs. Porsche: Ultra-High Power Hybrid Batteries Otmar Bitsche, Director of Battery Systems at Porsche AG, delivered the first keynote at the 2025 Advanced Automotive Battery Conference Europe, discussing a new high-power hybrid solution. Porsche did not come to discuss miles per gallon efficiency improvements; the battery pack in this vehicle is there to maximize power and performance. Their recent solution is a t-hybrid powertrain on a 911 that is now part of the production GTS model. This includes a battery pack up front— a 400 V lithium-ion system harboring just 1.9 kWh of energy—which is about the same weight as a normal lead acid battery. Compared to typical all-electric batteries, the specs aren’t initially outstanding— just 71 Wh/kg and 112 Wh/L. But according to Bitsche, “the most impressive data are really the power we can provide by this battery pack.” It provides 29 kW of continuous power and a maximum 50 kW output. To accomplish this, Bitsche says the battery operates at C rates just under 30. For context, production all-electric vehicles might drain the battery at 6C under hard acceleration, but those battery packs are often 30-50 times larger, so they can produce much more power. Getting 50 kW out of a 1.9 kWh battery is a feat. Formula 1 hybrid solutions do push these C rates yet higher, but those are not consumer vehicles with demands the Porsche must meet, such as operating at -25 °C or lasting for years of use. The GTS 911 also has a 3.6 L boxer gasoline engine, a single electric motor on the rear axle, and an electric turbocharger. The turbo offers some unique advantages. Normally, the function of a turbocharger is to use exhaust gas to spin a turbine to drive a compressor and feed compressed air into the engine, thus increasing the oxygen content and the power from each combustion event. An e-turbo can also harvest the energy from the spinning turbine. In addition to traditional braking energy regeneration, “we used the exhaust gas to regen the battery,” Bitsche said. Additionally, the battery can power and spin the turbo directly and provide boost pressure before the gas engine produces sufficient exhaust; then, once the e-turbo is producing electricity from exhaust gas, that energy can go into the electric motor or back to the battery. There is thus a dynamic balance of storing and releasing energy among these components. “This is really a very complex strategy but helps to give overall better performance and also better efficiency for the vehicle,” Bitsche said. Bitsche discussed specifics on the battery pack, which he said “needs extremely fast and reliable power response.” It’s composed of 108 parallel pairs of 21700 cylindrical cells, and those pairs are then connected in series. They’re using NMC-622/graphite, 2.5 Ah, 9 Wh cells. “We designed this cell dedicated for this very high power demand, from the electrode to the cell design, with the continuous tabbing… for this very very high performance application,” Bitsche explained. Operating between 30 and 70% SOC, he said they are able to provide full power. The internal resistance of each cell is < 7 mΩ, superior to most other cylindrical power cells that typically have resistance exceeding 10 mΩ. He also explained that they “have minimum resistance not only in the cell but also in the cell interconnects and all the cell connectors.” To maintain the demands of continuous 29 kW power output, the pack needs to deal with heat, and there’s a carefully planned cooling system. “We use a standard water-glycol system but with a very complex design of the cooling plate,” Bitsche said. A graphic showed cooling on both the sides and bottom of individual cells. With this design, he said they can get 2.4 kW of heat out of the battery pack continuously. To demonstrate the efficacy of their design, Bitsche showed race data from the famous Nürburgring. In less than 8 minutes of hard driving, the battery pack cycles in delivering nearly 50 kW of power and recharging, but the temperature only increases from 30 °C to about 50 °C. The improvements from this battery become clear when comparing the 911 with and without the t-hybrid setup. In 2.5 seconds, the 911 Carrera GTS covers 14.5 meters, but the t-hybrid variant is 7 meters ahead. Racing to 100 km/h, the GTS takes 3.4 seconds, but the t-hybrid can do it in 3 seconds flat. This all culminated in shaving 8.7 seconds off the prior model’s best time at the Nürburgring with the updated GTS. Volkswagen Bets on New Chemistries: Sodium-Ion, LNMO, Solid-State Volkswagen AG Head of Technology Development and Simulation Battery Cells and Systems Rouven Scheffler discussed battery technology in their range of vehicle offerings. He pointed out that within the battery division, PowerCo group is a cell supplier, whereas the Center of Excellence, of which he is a member, develops battery systems, working with both PowerCo and other manufacturers’ cells. He began with a focus point: an EV battery accounts for approximately 40% of the cost of the vehicle, so for the batteries, “it’s really important to bundle up all the competencies, all the know-how into one organization,” he said. “This is done with the Center of Excellence.” Volkswagen opts for a unified cell approach, a standardized prismatic form factor, intended to be used in 80% of EVs across its brands, that is amenable to different chemistries. Currently this is limited to NMC for range and performance and LFP for affordability. But Scheffler used his address to provide a future outlook, including their vision for sodium-ion, lithium nickel manganese oxide (LNMO), and solid-state batteries, considering how these technologies might

How Credo Beauty created new plastic from tiny bits of packaging

Less than 10 percent of single-use plastic is recycled, most of it bottles and jugs. That rate is far lower — close to zero, in fact — for smaller bits and pieces of packaging such as bottle caps, straws and coffee pods. In the cosmetics industry, for example, few of the 120 billion units of lotion pumps, mascara wands and other components made each year are recycled, according to the Pact Collective. The nonprofit has gathered 140 cosmetics makers and retailers — including Sephora, Ulta Beauty and L’Oréal — to attack small-format plastic waste. Pact maintains more than 3,300 bins for spent makeup jars, lids and applicators at North American stores including Nordstrom Rack and L’Occitane en Provence. To further its mission, the collective created something new from nearly 232 tons of detritus it has collected since 2022. Last year, as its collection volumes tripled, the organization transformed piles of plastics into a novel resin. Credo Beauty, a founding member of Pact, then used that resin, called NewMatter, to create recyclable pumps for its moisturizer bottles. Those pumps usually blend several types of plastic with a metal coil, which prevents its recycling. Credo, however, used a single material — polypropylene — to make it easier to recycle later. Now that it has cracked this challenge, Pact seeks to encourage investors and infrastructure builders to support systems to collect, sort and recycle more small-format plastics. “As the first beauty retailer to co-create a recycled resin from hard-to-recycle empties, we saw an opportunity to show circularity at work,” said Christina Ross, head of science and impact at Credo Beauty, a founding member of the Pact Collective of Colorado. “This pump became a proof point and we can’t wait to see what brands do with the material next.” Banding together As international negotiations continue on a global plastics treaty, Pact isn’t the only corporate collaboration trying to keep packaging components out of landfills and incinerators. In February, the Consortium for Small Formats launched with backing from L’Oréal Groupe, Kraft Heinz and P&G. Individual brands’ efforts at circular packaging include refill programs from the likes of Kiehl’s and customer collection programs for MAC Cosmetics. Members of the U.S. Plastics Pact, meanwhile, have focused on sweeping benchmarks for reducing the proliferation of petroleum-based plastics, but their 2025 and 2030 deadlines are slipping out of reach. “We are taking a different angle,” said Pact Collective Executive Director Carly Snider. “We’re collecting this material and then proving that it has value.” The initial heavy lift shows that certain cosmetics plastics can be integrated into municipal recycling systems, she added. “I’m hopeful that we can have this case study to show that this material has value, and therefore it’s worth the investment to your infrastructure for us to collect this material curbside.” A Pact collection bin at a Nordstrom Rack store in Skokie, Illinois. Credit: Trellis Group / Elsa Wenzel Pact’s June 26 impact report described how Credo’s custom pump, announced in September, fit into a busy year of scaling up recycling. Ninety-eight percent of the paper, glass and metal collected by Pact has been recycled. So has 70 percent of sorted, clean plastics. Retail collection bins are core to Pact’s mission to grow as a household name for consumers, three-quarters of whom care about sustainable packaging, according to the nonprofit. Pact also collected 88,959 pounds of industrial waste of returns and expired or damaged goods last year. The making of the NewMatter pump “We used NewMatter resin for the pump because we wanted to show that beauty packaging can be made from beauty waste,” said Ross of Credo. “No one had ever made a high-functioning component from post-consumer beauty packaging before, so we knew the road wouldn’t be easy but also that it mattered.” The journey to make the recycled pump started as Pact’s consumer-and-industrial packaging streams shipped to a plant in Lake Zurich, Illinois. After being sorted into 14 categories, the would-be trash was sent to mechanical recycling partners. Next, the plastic recycler shredded and turned the waste into pellets. Recyclers can require tens of thousands of pounds of a single source of material to create a resin. Pact’s limited run, however, involved a far smaller volume. Ultimately, the NewMatter resin blended material from Pact’s collection bins with ocean-bound plastic gathered by hand in Malaysia. The Credo pump included an 84 percent mix of NewMatter with 16 percent virgin polypropylene. “It took a lot of work with them to figure out ways that we can get this material in there,” Snider said. “This is a really high value source of plastic.” One pound of plastic waste stays out of landfills or oceans for every 38 pumps that Credo makes, according to Pact. Next steps Beyond the pump, Pact also turned recycled high-density polyethylene into soap dishes with Terrazzo-like flecks in them. “It’s really creating a way that customers can hold circularity in their hands,” Snider said. “It’s not this abstract thing.” Credo is exploring where else it can use NewMatter resin, such as closures and other components that tend to be hard to recycle. “Now that the infrastructure is set up to use take-backs on a more circular level, we need to continue to create a demand for post-consumer beauty-grade materials,” Ross said. That includes exploring how extended producer responsibility regulations cropping up in multiple states can help brands to advance innovative packaging, she added. “You’re missing a huge piece of the puzzle here by just sending this to the landfill and not being able to sell it again,” Snider, of Pact, said. The post How Credo Beauty created new plastic from tiny bits of packaging appeared first on Trellis.