Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the 10-year back catalogue is included as part of a subscription to Energy-Storage.news Premium.

The front-of-the-meter (FTM) energy storage industry in Europe is experiencing rapid growth. Projects are

becoming larger and revenue streams are diversifying, with energy storage playing an increasingly critical role in balancing electricity grids.

New markets are emerging—such as Poland and the Baltic states—where ancillary services have recently opened, creating fresh opportunities for investors and developers. At the same time, some established markets are reaching saturation. In the UK, for example, ancillary service revenues have declined as competition has increased. Similarly, in France, the primary reserve market has become crowded. These shifts are forcing market participants to explore new strategies to optimise returns.

Meanwhile, the increasing penetration of renewable energy is driving greater electricity market volatility. As wind and solar generation fluctuate, energy storage is becoming essential for stabilising supply and capturing price spreads. This trend is unlocking new opportunities in wholesale electricity markets and balancing services.

However, taking advantage of these opportunities is far from straightforward. Estimating potential storage revenues remains a complex challenge. Earnings in real-time electricity markets depend on multiple factors, including market conditions, regulatory frameworks and battery energy storage system (BESS) trading strategies.

Without a deep understanding of these dynamics, investors risk overestimating or underestimating potential revenues, leading to suboptimal investment decisions.

BESS markets in key European countries

When examining the leading markets for operational energy storage capacity in Europe, the UK stands out as the dominant player by a significant margin. The growth of the UK’s energy storage market has been propelled by targeted auctions held several years ago, which allocated substantial amounts of energy storage capacity. Additionally, the UK has established lucrative ancillary services markets, which have been highly remunerative, attracting large-scale investments in energy storage.

Germany ranks second in Europe, with approximately 1.5GW of installed energy storage capacity. While most of these systems were originally designed to provide primary reserve, a shift has occurred as prices in this market have decreased. As a result, Intraday and secondary reserve markets have become the primary sources of revenue for storage operators.

France follows closely behind with nearly 1GW of energy storage capacity. A significant portion of this capacity is owned by NW Group, while the remaining projects were awarded through the long-term capacity mechanism auction.

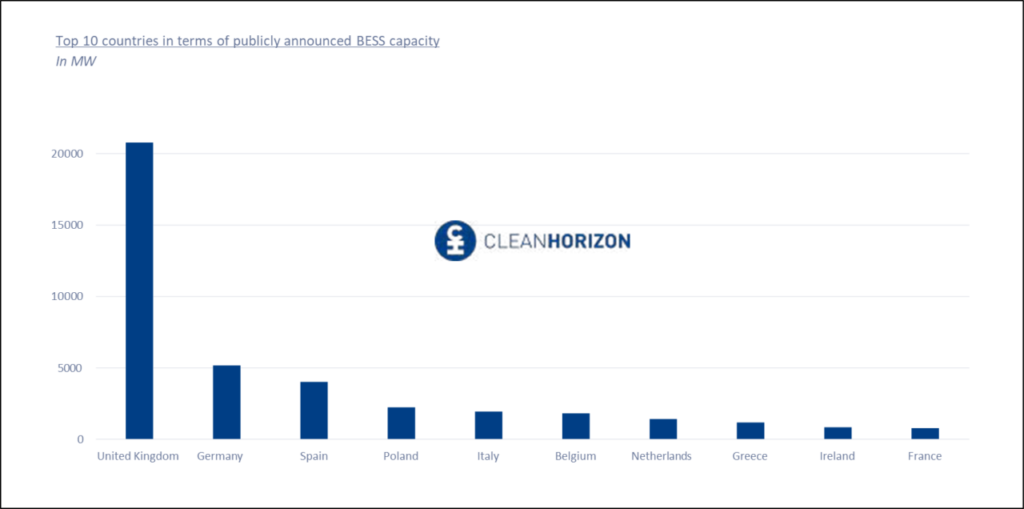

The ranking of the top 10 European countries based on announced energy storage capacities (Figure 2 below) differs significantly from the graph in Figure 1 above. The data presented here is sourced from the Clean Horizon Energy Storage Database (CHESS), which exclusively includes publicly announced projects.

Notably, Spain and Poland feature prominently in the top 10. These countries are becoming hotspots for energy storage developers, thanks to their generous subsidy programmes and substantial market opportunities. Italy has also implemented compelling mechanisms to attract investment, such as the Fast Reserve auction and long-term capacity mechanism auctions.

Similarly, Belgium has emerged as an appealing market, with numerous developers undertaking large-scale projects, particularly to capitalise on high market volatility and ancillary service prices.

What are the key revenue streams for energy storage in Europe?

The main differences between those countries are the revenue opportunities for battery energy storage systems (BESS). Storage assets can get remunerated by providing different types of services to the grid, from shifting consumption to times where the electricity is cheaper to helping the grid ensure frequency stability. Each of those services enable storage assets to generate revenues.

Wholesale markets: intraday, day ahead

The day-ahead market is the primary wholesale electricity market in Europe. Its main purpose is to allow electricity producers, suppliers and traders to buy or sell electricity one day in advance, based on improved forecasts of consumption and production. The market operates on a pay-as-clear auction system, where the last asset selected to meet demand sets the market price for each hourly period. This auction closes at 12:30 PM CET the day before delivery.

Prices on the day-ahead market fluctuate significantly depending on the balance between supply and demand:

• When demand is largely met by low-cost renewable generation, prices tend to decrease and can even become negative during periods of high renewable output and low consumption.

• Conversely, when demand is high and more expensive thermal power plants are required to meet it, prices rise considerably.

For battery energy storage systems, these price fluctuations create an opportunity known as energy arbitrage. Storage assets can charge during periods of low prices—typically around midday when renewable production is abundant—and discharge during high-price periods, often

in the evening when demand peaks and renewable output decreases. The revenue generated from this strategy is essentially the difference between the evening price and midday price, adjusted for the battery’s efficiency. This difference is referred to as the price spread.

Beyond the day-ahead market, BESS can also generate revenues in the Intraday market, which allows trading closer to the actual time of electricity delivery. The Intraday market is divided into two segments:

• Intraday Auctions: Similar in structure to the day-ahead market but held multiple times a day and closing nearer to realtime delivery.

• Intraday Continuous Market: A fundamentally different mechanism, this is a continuous order book where market participants can place buy or sell orders for electricity until as little as 5 minutes before delivery. Trades occur when matching orders are found.

The Intraday Continuous Market was originally introduced to help electricity players minimise imbalances in their portfolios, particularly as renewable production forecasts improve closer to real time. Liquidity in this market tends to increase during periods of high demand, high renewable output, or when imbalance penalties are significant.

For energy storage operators, this market offers additional flexibility to capture price spreads and optimise their revenues beyond the day-ahead auction. In the Intraday Continuous Market, trades can be placed as early as two days before the delivery period and up to five minutes before delivery.

Storage operators typically engage in a dynamic trading strategy by placing successive buy and sell orders at different price levels for the same delivery slot.

Ancillary services

Most European countries within the Continental Europe Synchronous Area (CESA) are interconnected and operate on the same electrical frequency. This synchronisation means that any frequency deviation or electrical instability in one country can quickly affect the entire area. As a result, these countries have developed similar ancillary services markets to maintain grid stability and security.

In contrast, the Nordic countries (such as Sweden, Norway and Finland) form a separate synchronous area, not synchronised with Continental Europe. Their ancillary services markets are therefore designed differently, often reflecting the higher share of renewable energy in their systems and the specific flexibility needs of their grids.

Synchronous areas use ancillary services to maintain their frequency close to its nominal value. Ancillary services used to be provided mainly by flexible power plants such as thermal, hydro and nuclear (in the case of France). In most countries, ancillary services are procured through auctions for delivery timeslots that typically range from one to four hours in reservation markets and from 15 minutes to one hour in energy activation markets.

The primary reserve is the first line of defence against frequency deviations in the power system. It automatically responds within seconds to stabilise frequency across the synchronous area. This service is commonly referred to as the Frequency Containment Reserve (FCR). Storage and other flexible assets providing FCR are typically remunerated through capacity payments. They are paid for making their capacity available to deliver frequency support, usually contracted the day before delivery through daily auctions or tenders. The asset earns revenues whether it is activated or not, simply for being available to respond.

Then, the secondary reserve, known as the Automatic Frequency Restoration Reserve (aFRR), is activated to restore frequency to its nominal value and balance electricity supply and demand at the national level.

The aFRR market structure generally includes two revenue streams:

• A capacity payment for reserving the asset’s flexibility in advance, typically secured in a day-ahead market.

• An energy payment when the asset is activated in real time by the Transmission System Operator (TSO) to deliver energy.

Efforts are underway to harmonise aFRR market operations across Europe. The PICASSO project, led by European TSOs, is standardising the activation of aFRR energy at the European level, allowing cross-border participation and facilitating a more integrated balancing market.

Finally, tertiary reserves are marketed similarly to secondary reserves in most European countries, with the aim of balancing electricity supply and demand. However, this market can prove to be very volatile, namely in countries with high renewable penetrations, such as the Nordics.

Subsidies and capacity mechanisms

In addition to wholesale and ancillary services markets, some European countries have implemented specific mechanisms to support the development of new technologies such as energy storage. These mechanisms aim to ensure security of supply while encouraging the integration of flexible assets that can help balance increasingly renewable-heavy power systems.

One of the most widespread support schemes is the capacity mechanism. This mechanism provides financial incentives to assets that commit to being available during periods of high demand or system stress, regardless of how often they are dispatched. Energy storage systems can participate alongside conventional generation, providing flexibility and reliability to the grid.

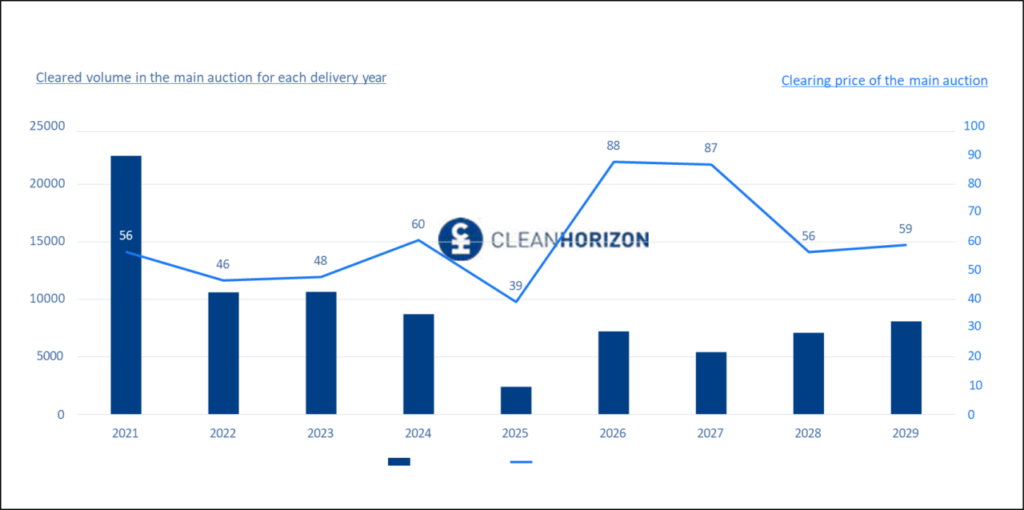

A notable example is Poland, where the capacity market has played a major role in fostering storage development. As of the latest auctions, Poland’s capacity mechanism has awarded contracts to over 2.5GW of battery energy storage systems, expected to be commissioned by 2029. This significant pipeline reflects both the country’s ambition to modernise its grid and the growing recognition of storage as a key enabler of energy transition.

In addition to market revenues, public support schemes also play a vital role in accelerating energy storage deployment in Europe. A notable example is Spain, which has introduced dedicated funding for energy storage projects under its Recovery and Resilience Fund.

In October 2023, Spain launched a large-scale tender as part of its PERTE (Economic Recovery and Transformation Strategic Project) framework, specifically for 4-hour stand-alone battery energy storage systems (BESS).

The results of this tender highlight the country's strong commitment to supporting energy storage deployment:

• A total of 805MW/3,589MWh of storage capacity was awarded nationwide.

• Of this, more than 690MW/2,820MWh of battery systems were allocated in mainland Spain and the islands. In mainland Spain alone, 635MW/2,585MWh of projects were selected, equivalent to a total public grant of €128 million.

All the winning projects consisted of 4-hour energy storage systems, reflecting Spain's strategy of prioritizing long-term energy storage to better integrate renewable energy.

Revenue Optimization

As mentioned above, battery energy storage systems (BESS) are able to provide a wide range of services in various electricity markets, most of which operate at hourly or sub-hourly resolution. To fully capture the value of these services, BESS operators must optimize their participation in all accessible markets.

This complex task is performed by specialized entities known as route to market (R2M) providers. R2M providers are responsible for ensuring that energy storage assets participate in the most profitable mix of markets while adhering to technical and regulatory constraints. This involves making strategic decisions both before delivery (D-1) and in real time.

On the day before delivery (D-1), R2M must decide how to allocate the asset capacity across the following markets:

• Day-ahead wholesale markets

• Intraday bidding markets and intraday continuous trading

• Ancillary services reservation markets (e.g. FFR, FCR, aFFR, manual frequency restoration reservation (mFRR))

These decisions are based on factors such as:

• Expected market prices

• Participation requirements (e.g. prequalification, state of charge restrictions)

• Expected revenues from real-time markets (aFRR energy, mFRR energy, intraday continuous)

Once the day-ahead position is acquired, R2M must manage the asset’s operations in the real-time energy markets, ensuring it delivers on the promised services while maximizing additional trading opportunities in the following:

• aFRR energy market

• mFRR energy market

• Intraday continuous market

Clean Horizon Energy Storage Index: Benchmark for Energy Storage Revenues

To provide a transparent and standardized benchmark for energy storage revenues across different markets in Europe, Clean Horizon has developed an Energy Storage Index. The index is updated monthly and reflects the annualized revenue potential of a reference energy storage asset, based on market prices in a particular month.

The Storage Index aims to answer a simple question: What is the expected annual revenue of a storage asset if the price pattern throughout the year is the same as that observed each month?

The Storage Index is calculated using Clean Horizon’s proprietary sophisticated energy storage simulation tool, COSMOS, which replicates real-world market behavior and decisions.

By following a transparent, conservative and standardized methodology, the Storage Index provides a valuable reference for investors, developers and policymakers seeking to assess and compare the revenue potential of energy storage assets across multiple European countries.

Some key trends can be observed across the five countries, which fall into three main categories:

• Emerging markets such as Poland and Spain, which have announced large-scale energy storage projects that are expected to be commissioned in the next few years, but current installed capacity is still low.

• Intermediate markets, such as Sweden, where the energy storage market is expanding, but the primary reserve market (especially FCR) is close to saturation.

• In mature markets such as France and Germany, energy storage is already well established and key markets such as FCR are saturated, leading to increased competition, declining revenues, and new market opportunities that are critical to maintaining a profitable BESS business case.

In all of these countries, the largest profit opportunities typically occur when new markets open up. This is a critical moment for storage operators as prices tend to rise sharply due to limited competition and the need for new flexibility providers. Recent examples include France’s aFRR capacity auction, which launched in June 2024, and Poland’s ancillary services market, which launched at the same time.

These events have led to significant growth in the profitability of storage assets. Once the primary reserve market is saturated (such as in France and Germany), the profitability of 1-hour battery energy storage systems declines. In this mature environment, 2-hour and longer battery energy storage systems become increasingly attractive as they allow operators to access a wider range of markets, including energy markets as well as secondary and tertiary reserve markets.

随着市场发展和饱和,跨市场优化变得至关重要。在早期阶段,例如2023年的瑞典,其大部分收入完全来自FCR-D,这使得市场参与变得简单。然而,一旦这些市场饱和,在所有可用市场中实现电池储能系统(BESS)参与的多元化就变得至关重要,以利用波动的价格信号——例如,利用mFRR或能源市场中的机会来抵消FCR收入的下降。

这种跨市场优化策略对于长时电池储能系统 (BESS) 尤其有效,因为它在循环和能源调度方面提供了更大的灵活性。

关于作者

Rachel Locquet 是 Clean Horizon 的首席顾问,该公司是一家提供储能市场分析和技术咨询服务的咨询公司。Rachel 的职责包括储能培训、市场分析、电力和辅助服务价格预测、储能商业模式优化以及商业尽职调查。